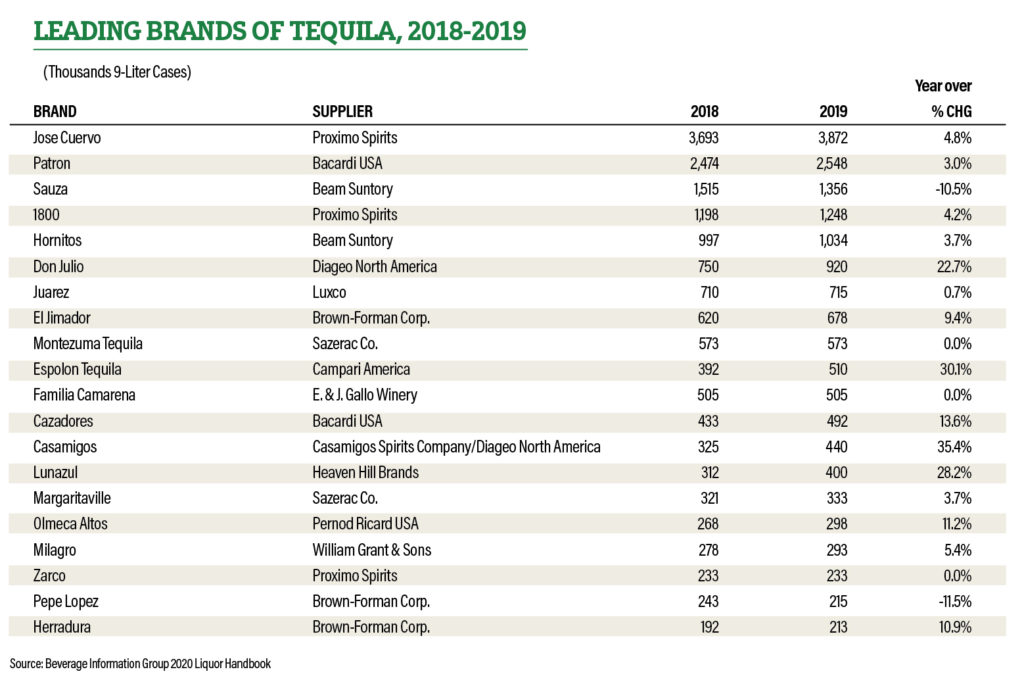

Consumer thirst for tequila and other agave spirits keeps propelling the category to new heights. Tequila consumption in the U.S. rose from 15 million 9-liter cases in 2015 to 19.8 million cases in 2019, according to the Beverage Information Group’s 2020 Liquor Handbook. Tequila jumped 6.6% from 2018 to 2019, and by most estimates was on track to far exceed that increase in 2020.

“Tequila is by far our most popular spirit,” says Mike Moreno of Moreno’s Liquors in Chicago, which stocks hundreds of brands of tequila. “Our top tequila brands currently are Corralejo, Gran Centenario and Clase Azul,” he notes.

Single barrel picks have heated up in the category. “We currently do roughly 20 single barrels a year for tequila alone,” says Moreno.

Legacy Wine and Sprits in Little Rock, AR, carries roughly 55 different brands of tequila, says purchasing manager and certified Cicerone Jake Dell. Based on 2020 sales numbers, tequila is Legacy’s third-best category in spirits, behind whiskey and vodka.

“We stock all of the big multinational brands, like Patron, 1800, Don Julio, Jose Cuervo, etc.,” Dell notes. “But we are also seeing an influx of smaller, boutique tequila products in our store.”

The retailer has seen a sizable shift to premiumization in the tequila category. What’s been selling well lately at Legacy?

“Don Julio 1942 is extremely popular in our store,” Dell says. “Clase Azul, with their ornate painted bottles are also very popular—and hard to even keep in stock these days.” Legacy sells “boatloads of Patron silver as well,” he adds.

Consumers always look for the next hidden gem that their friends haven’t tried, and tequila is no exception, Dell notes. “Exclusivity is valued, just like in the high-end wine and whiskey categories—more so than in vodka or gin, where people tend to stay much more brand loyal.”

Tanteo Tequila in January announced a new label targeting the on-premise: Espero Blanco Tequila. The traditionally distilled, 100% agave Espero—which means “I hope” in Spanish—is priced for the premium well, with suggested retail of $29.99 per liter bottle.

“We love to able to offer our guests a great product at an approachable cost,” says Jose Lopez, the general manager at Empire Diner and the AGM at Cafeteria in New York, which stock Espero Silver as the well tequila. “It tastes like a premium tequila for which you would pay a lot more,” he says.

Mezcal matters

The enduring popularity of tequila has increased curiosity about and consumption of mezcal, tequila’s smokier cousin. At Moreno’s, “mezcal is one of our fastest-growing categories, right on par with American whiskeys,” Moreno says.

When it comes to mezcals, there seems to be more fluctuation in the popular brands compared with tequila, he says, “but Del Maguey and Banhez are still the drivers.” Moreno’s currently stocks more than 450 mezcals.

Legacy carries about 15 producers of mezcal, with different age statements and expressions under each label, Dell says. “Our most popular mezcals are produced by Wahaka.”

El Crisol in Tucson, AZ, is an agave-spirits-focused bar, with mezcal dominating, says founder Doug Smith. “So mezcal is far and away our most popular spirit. The education program we have, involving weekly tastings and presentations on production regions, production methods and different mezcal types, has certainly helped seed the spirit in the minds of our guests.”

Sipping and savoring is the way to approach the enormous complexity of all kinds of mezcal, Smith explains “Most people begin with an espadín on the lower end of the price scale and go up from there to the rarer, wild species mezcals.”

More consumers seem to enjoy sipping their agave spirits neat. Orders of single servings of tequila and mezcal spiked for Kimpton Hotels & Restaurants in 2020, according to its annual trend report.

Agave-based cocktails

Mezcal is quite versatile as a cocktail base, says Smith. “Cocktail design is about combining ingredients to produce something that exceeds the sum of its parts. The smoke characteristic of mezcal can be a real asset here, but it might also get in the way of the expression of other ingredients.”

Also, the wide range of flavor profiles in mezcals allows for many permutations, which makes it fun to experiment, he notes. That said, mezcal tends to be expensive, “so one has to be careful about costs and pricing.”

El Crisol’s flagship cocktail is the Casa Verde, essentially a Margarita using mezcal, a syrup infused with the native creosote plant, and lime juice, priced at $9.

Other cocktails include The Cortante Simpático, with tamarind and orange-peel-infused mezcal, Pajarote Tamarindo licor and lime juice ($11); The Magi, with frankincense-infused San Luis Potosí mezcal and chrysanthemum bitters ($10); and The Rose Cloud, with sotol, rose syrup and lemongrass oxymel ($11).

Mixologists continue to go beyond the basic Margarita or Paloma in creating spicy savory sips that complement a variety of different cuisines. For example, Arie Gunawan, beverage director at New York’s Peruvian-Japanese fusion restaurant Nobu Downtown recently added the Pina Caliente tequila cocktail to the menu as a seasonal special.

The Pina Caliente combines One With Life (OWL) organic blanco tequila infused with jalapeño, cilantro, pineapple, yuzu juice and Calpico Japanese citrus milk. Gunawan used OWL blanco for its multilayered flavor profile that could stand up to the more complex flavors of cold-weather drinking.

Nobu Downtown also offers a Mia Margarita to-go, made with Corralejo añejo tequila, passion fruit, lime, spiced honey and shichimi spice mixture. The 12-oz. chilled, bottled cocktail is priced at $32.

Taco Cabana, a subsidiary of Fiesta Restaurant Group that operates 145 units in Texas, offered several new seasonal Margaritas this past year. Fall flavors included Pumpkin Spice, Sour Gummy and Blood Orange Margaritas, while holiday offerings included Candy Cane and Apple Spice. Special limited-time offerings this year have included the pomegranate-lavender Love Potion Margarita for Valentine’s Day, available for $2, and the MardiGraRita ($3), a blend of strawberry, blue Curacao, mango and lime.

The Margaritas were available with food purchase with online ordering for counter and curbside pick-up, via the drive-thru or by mobile order, as well in the restaurant dining rooms where they were open.

The lobby level bar at the Plaza Hotel Pioneer Park in El Paso, TX, boasts one of the largest selection of tequila and agave spirits in the nation. Its drink specials for National Margarita Day this past Feb. 22 included the Tequila Rose cocktail, with blanco tequila, lime juice, strawberry puree, coconut water and sparkling wine, shaken and served in a Champagne flute.

Covid’s effect

For certain, tequila, Margarita kits and Margaritas to-go have become brisk sellers during the Covid pandemic. “We saw a dramatic increase in tequila sales when Covid-19 forced people to stay home and quarantine,” Dell says.

Why? “It’s known around here that the drink of choice of the typical non-drinker/social drinker is a Margarita: Simple to make at home with just the spirit and premade mix.”

While the pandemic has boosted tequila demand, the downside is that it will exacerbate the agave shortage, Moreno says.

The coronavirus shut down El Crisol completely, Smith says. “Under a relaxation of liquor license rules put in place by the governor of the state, we were offering virtual mezcal tastings and cocktails to-go for a while. But after a court ruling terminated those dispensations two or three months ago, we have been in total hiatus.”

But he remains optimistic that the bar will resume, and his plan is to deepen El Crisol’s mission. “That is, we intend to fix our identity as an agave spirits and sotol tasting room. We’ll still be a bar offering cocktails, wines, and beers, but we plan to hone our selection of agave spirits, specialize particularly on mezcals from the Mexican north, strengthen our relationships with producers in Mexico and enhance our education programs.”

In short, Smith says, “we’ll get even more grounded and nerdier.”