They may not generate the excitement of fast-growing spirit categories such as American whiskey and tequila, but cordials and liqueurs remain an integral component in classic cocktails and modern mixology. The diverse segment encompasses creamy, dessert-like sips, fruity cordials and sweet, flavored-whiskey expressions, as well as bitter aperitifs.

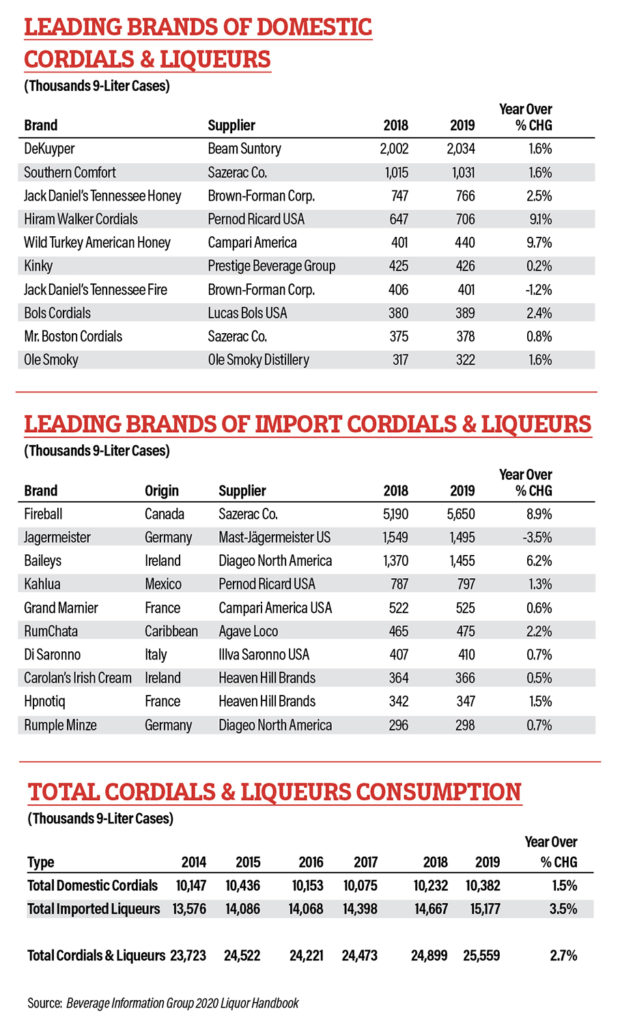

Consumption of cordials and liqueurs increased 2.7% in 2019, according to the Beverage Information Group’s 2020 Liquor Handbook (a sister brand of Cheers), reaching 25.6 million 9-liter cases in the U.S. The category also maintained its 10.7% share of the total distilled spirits category, and is second only to vodka, though tequila and straight whiskey may soon surpass it in share.

With the exception of 2016, the category has stayed in growth mode these past nine years, with an average annual increase of 3%. The top six cordials and liqueurs suppliers represented 67.3% of U.S. volume. The top three—Sazerac Co., Beam Suntory and Diageo—held a 50% share of the category as each company slightly expanded their share.

All of the top-10 domestic and imported brands posted some sort of growth, except for Jaegermeister, which fell 3.5%, and Wild Turkey American Fire, which slipped 1.2%. The leading domestic brands tend to be whiskey-based liqueurs and fruit cordials, while several top imported liqueurs lean toward more decadent, cream beverages.

Fresh expressions

Many brands have expanded their lines to bring in new customers and extend seasonality. For instance, Disaronno this past spring released Disaronno Velvet cream liqueur, which combines almond with nuances of chocolate and vanilla. Grand Marnier in 2019 launched a new expression called Cuvée Louis Alexandre to honor the brand’s creator, Louis-Alexandre Marnier Lapostolle.

Baileys has unveiled a number of line extensions in recent time, including Almande, made with almond milk; Strawberries & Cream; and a number of seasonal flavor releases. India-inspired liqueurs brand Sōmrus in September introduced Sōmrus Coffee cream liqueur, which joins its Mango and Chai products.

RumChata, which earlier this year launched a Limon flavor, has just unveiled a cold brew coffee FrapaChata expression. Jägermeister also got into the cold brew liqueur arena with last year’s release of Jägermeister Cold Brew Coffee, which pairs the brand’s traditional herbal liqueur with flavors of Arabica coffee and cacao. Coffee liqueur brand Kahlúa this past summer rolled out a Nitro Cold Brew ready-to-drink canned cocktail.

A number of brands have also recently refreshed their packaging, including Pama Pomegranate liqueur and passion fruit liqueur Passoã.

Bitter thrill

The return of classic cocktails has given new life to several long-time liqueur brands. Campari, which saw stagnant consumption in the U.S. for decades, has been growing thanks in large part to the Negroni. Campari rose 13.6% last year to 159,000 9-liter cases.

Mixologists have put their own creative spins on the cocktail—even in Italy. The luxury Rome Cavalieri, A Waldorf Astoria Hotel, offers a fall version of the Negroni called the Centenarius (shown atop), made with Rivo foraged Sloe Gin, Campari infused with cinnamon and clove and Carpano Antica Formula vermouth.

But it’s the consumer interest in aperitivo culture and spritz drinks that has really boosted sales of bitter liqueurs, namely Aperol. The orange-hued aperitif has become Campari’s largest brand, more than tripling in size during the past

three years.

The new classics

Aperol surged 50.6% in 2019 to 241,000 cases, driven by the popularity of the Aperol Spritz cocktail. While the simple drink—Aperol, prosecco and soda water—has been a favorite in Italy for decades, it’s only recently caught on in the U.S. in the past five years or so.

Another European spritz cocktail, the Hugo, is poised for takeoff in the American market. Created in 2005 by bartender Roland Gruber in the South Tyrol region in northern Italy, the Hugo combines mint, lime, elderflower, prosecco and sparkling water.

The drink quickly gained popularity in Austria and Germany, and has become a summer cocktail favorite across Europe. The original Hugo typically uses elderflower syrup, but more recent iterations incorporate elderflower liqueur. That’s good news such for brands as St. Germain.

A coffee drink imported from Mexico, the Carajillo, has cropped up in home bars and on several drink menus in the U.S. A combination of espresso and Licor 43—a Spanish liqueur made with 43 flavor ingredients—poured over ice, the Carajillo is becoming a classic cocktail, at least on the West Coast.

Charity Johnston, the Los Angeles-based director of operations at The Madera Group, which includes the Tocaya Organica and Toca Madera restaurants, makes a layered Carajillo sprinkled with cinnamon and garnished with a sprig of thyme. She attributes some of the drink’s popularity to consumer interest in making dining and drinking a full experiential occasion—whether in a restaurant or at home.

People are drinking more “European-style” now, Johnston says, giving more consideration to the entire experience of what they’re drinking before and after the meal. That could be a good sign for the cordials and liqueurs category.