After the pandemic-driven turmoil of the previous year, 2021 proved to be decent for the wine industry. As vaccines rolled out and Covid restrictions lifted, consumers started gathering again with friends and entertaining.

Weddings, parties and picnics resumed. Restaurants and hotels reopened, tentative travel came back and people began leaving their homes and enjoying adult beverages at on-premise establishments.

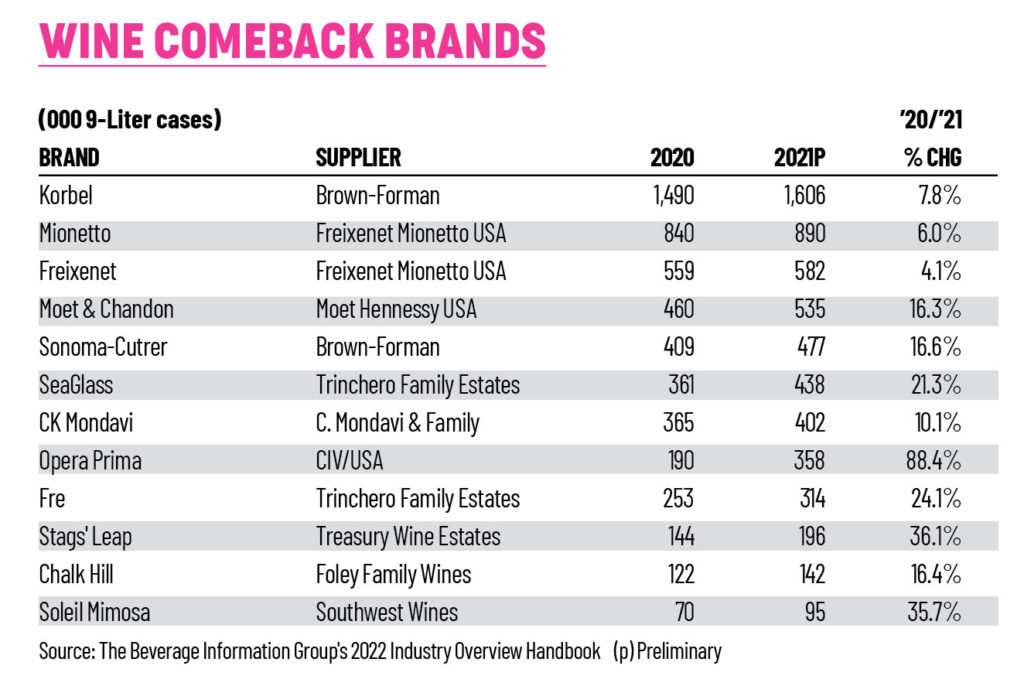

As with many brands at the onset of Covid, “we were not exempt from seeing a dip in sales across our Champagne portfolios,” says Anne-Sophie Stock, vice president of Veuve Clicquot — an Established Growth Brand winner — and Comeback Brand Moët & Chandon for Moët Hennessy USA. “That said, by fall 2020 we were seeing an incredible rebound in sales, where our consumers were placing a large emphasis and importance on celebrating everyday moments at home or in intimate groups.”

Still, a “decent” year for wine overall these days essentially means flat consumption. Wine faces numerous headwinds, namely losing market share to spirits and cocktails, as well as competition from ready to drink (RTD) offerings and hard seltzer products.

What’s more, Baby Boomers are drinking less wine these days, and younger consumers not embracing wine as much as expected. The Beverage Information and Insights Group projects that total wine volume dipped nearly 0.5% in 2021, to 348.9 million 9-liter cases. Volume had been up 1% for 2020.

With the challenges wine faces in retaining consumers while bringing in the younger generation of legal-age drinkers, growing significantly these days is a major achievement. Here’s a look and some of the trends and promotions that have helped this year’s crop of wine Growth Brand Awards winners prevail.

Health, Wellness and Lower-ABV Wine

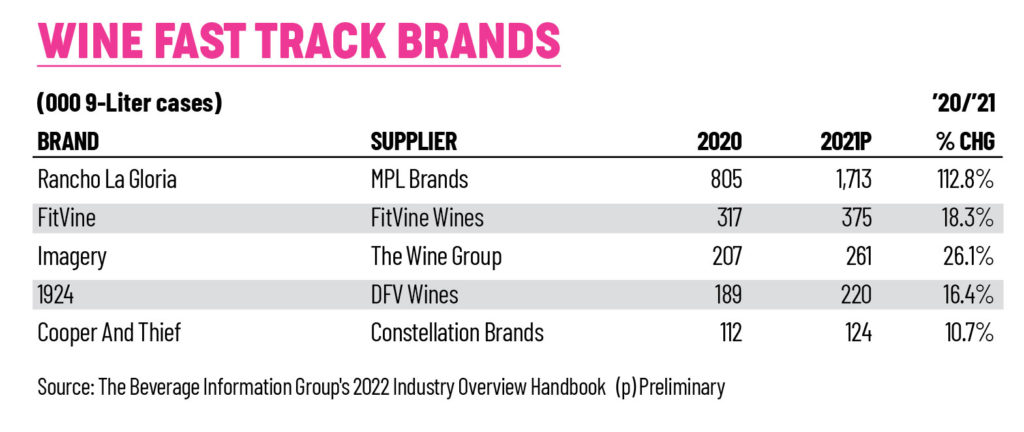

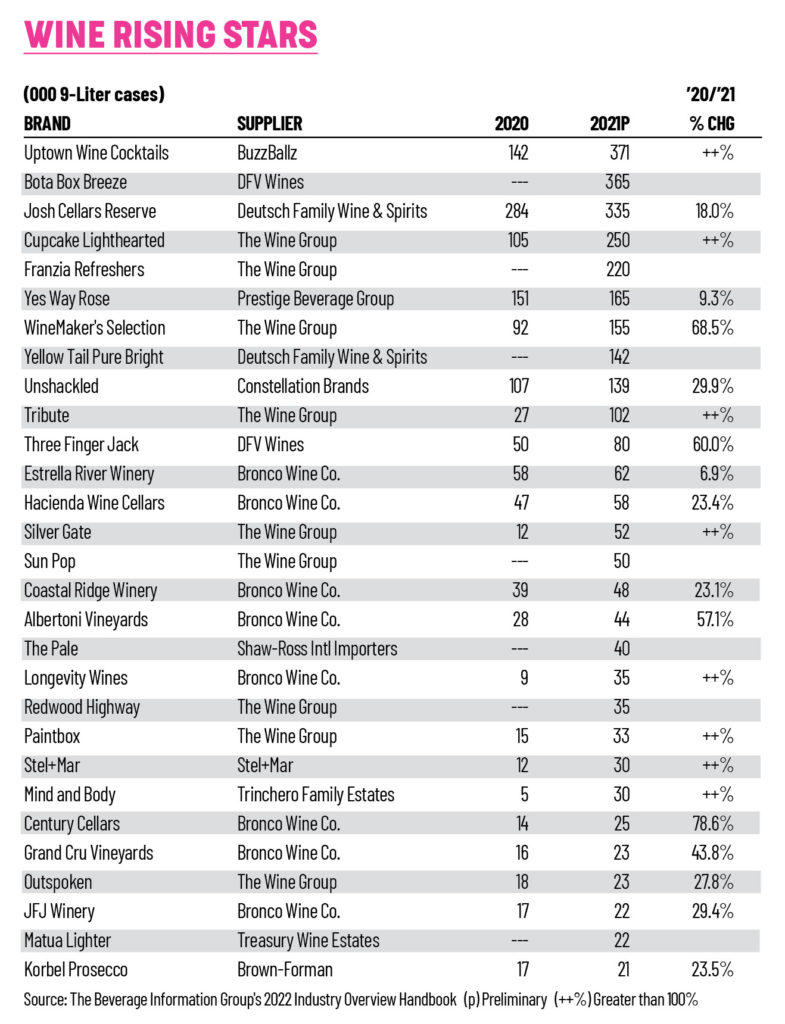

The better-for-you beverage trend shows no sign of slowing, and several winemakers have taken notice. FitVine, wines with less sugar, fewer sulfites and no flavor additives, won a Fast Track Award in 2022. Treasury Wine Estates in 2021 launched Matua Lighter, a lower-calorie version of its classic New Zealand sauvignon blanc; the brand won a Rising Star Award this year.

Delicato Family Wines in February 2021 rolled out Bota Box Breeze, a line of 3-liter boxed wines that’s lower in calories, carbohydrates and alcohol. Bota Box Breeze, available in Pinot Grigio, Dry Rosé and Red Wine Blend, is a Rising Star winner in 2022.

“Consumers are looking for premium lower-alcohol items in a variety of flavors including light fruity tastes,” says Christina Flom, brand manager for Risata Wines, which won an Established Growth Brand Award this year. “This trend has fueled our innovation this year and positioned the brand well, as we primarily offer low-ABV semi-sweet wines.”

Jeff Dubiel, chief marketing officer of The Wine Group agrees. The company’s lower-calorie Cupcake LightHearted, launched in summer 2020, won a Rising Star award this year.

“The ‘better-for-you’ wine category has seen a meteoric rise due, in most part, to the health and wellness macro-trend,” Dubiel says. Beverage alcohol consumers are increasingly looking for options that are lower in calories, sugar and alcohol, “product benefits that Cupcake LightHearted successfully meets for consumers, without sacrificing the taste they expect.”

Today’s consumers are more concerned about what they put in their bodies, and look for offerings that are lighter and lower in alcohol, says Nikki Huganir, who cofounded Yes Way Rosé with Erica Blumenthal in 2018. Yes Way Rosé — a Rising Star winner— is “the full package, with elegant French wine from a refreshingly modern and stylish brand available at an approachable price point.”

The explosion of consumer interest in no/low-alcohol wines made 2021 a successful year for Trinchero Family Estates FRE and Mind & Body. FRE Alcohol-Removed Wines, founded more than 30 years ago, received a Comeback Brand Award; Mind & Body, a premium, low-calorie, low-alcohol brand that launched in January 2021, is a Rising Star.

Both brands are already off to a strong start in 2022, says Brie Wohld, vice president, marketing for Trinchero Family Estates. This past January, Mind & Body saw triple-digit growth compared to 2021. Similarly, FRE saw 26% growth in January 2022 compared to January 2021, and 88% growth compared to January 2020.

On the retail front, Wohld says, more stores have created “better-for-you” wine sections to help wellness-minded consumers discover and locate Mind & Body and others its competitive set on-shelf. “Mind & Body has integrated new bottle neckers that highlight key aspects of the brand — displaying Mind & Body’s reduced calorie count and lower ABV — help differentiate our offerings and educate the consumer.”

It also helps that many hotels and restaurants have started to integrate lower-calorie menus that include beverages, she says. “Our teams are hard at work recommending Mind & Body to our customers as they develop lighter-calorie menus; this support will continue to bolster and grow Mind & Body on-premise.”

Millenial Mindsets with Wine

The health and wellness trend is also a way to reach younger consumers. Cupcake LightHearted, for instance, appeals to Millennials, Dubiel says.

“This is a cohort that is reaching a stage in life where they are becoming increasingly conscious of what they are consuming,” he notes. “Millennials have been the driving force behind many of the biggest trends in health and wellness, and it’s clear they are expecting the same choices when it comes to the alcbev space.”

FRE Alcohol-Removed Wines has grown by connecting with younger consumers who seek a balanced lifestyle, Wohld says. “Nearly half of the brand’s consumer base belongs to the Millennial and 21+ Gen Z generations — a rate well above the representation of those generations in the total wine category.”

Mind & Body wines are all about balance, Wohld says. “Today’s younger consumer wants to be able to enjoy their favorite beverages without having to make sacrifices. Positioned as a low-calorie, low-alcohol wine, Mind & Body allows this consumer to achieve that balance they crave.”

Beyond what’s in the bottle, Mind & Body’s eye-catching, modern packaging also speaks to a younger, vibrant consumer, she adds. “Mind & Body’s investment in digital marketing has been instrumental in reaching this key audience.”

Risata this year plans to launch Risata Peach and Risata Blueberry flavored wines, Flom says. “We see these two flavors over-indexing with consumers, and our fan base continues to look for additional low-alcohol flavorful wines.”

Yes Way Rosé Spritz, introduced in 2021, taps into the fast-growing RTD/seltzer-centric category, Huganir says. Initially available in Pink Lemonade and Peach & Ginger flavors, the Spritz beverage has 5g of sugar, 93 calories and 5% alcohol.

The company recently launched a Blueberry & Lavender Spritz expression. “Both blueberry and lavender are very ‘on trend’ with consumers right now, and they complement the classic French rosé base very well, so we have high expectations of the success of the product,” Huganir says.

Premium Preferences

Consumers that have been pent up and sidelined during the pandemic have been eager to celebrate with premium products.

“Over the last two years, we have seen a rapid growth and rebound in sales, and are still seeing our numbers increase as consumers continue to enjoy our Champagnes,” says Moët Hennessy USA’s Stock. “Not only are people continuing to drink Veuve Clicquot and Moët & Chandon at home, a trend that skyrocketed with the circumstances of 2020, but they are now back in restaurants, bars, events and in-person celebrations with friends and loved ones, and are choosing our offerings.”

Consumers are willing to trade up for a nicer bottle of wine, she notes. “Overall, we are seeing a shift in consumer behavior where people are opting for quality of wines and Champagnes, rather than quantity.”

Indeed, since many are still dining out less, “Consumers are more open to trying new things and are also willing to trade up and spend a little more as many want to drink less but better quality,” says Billy Lagor, senior vice president, brand management, for Meiomi Wines. Meiomi won an Established Growth Brand Award this year, while the company’s Unshackled brand is a Rising Star winner.

“Meiomi is proud to be the leading ultra-premium wine brand priced $15 and above,” he says. “Our wines have gained a loyal following over the years and are really loved for their flavor, balance and approachability.”

Unshackled launched in early 2020, just a few months before the start of the pandemic. As such, consumers were sticking to brands that they were familiar with, and it wasn’t possible to drive trial at consumer events or introduce them to the brand on-premise, says Bukola Ekundayo, Unshackled’s general manager. “We were able to overcome those challenges by leveraging the endorsement of The Prisoner Wine Company parent brand to drive trial.”

With an average suggested retail price of $24 to $29, “Unshackled represents fine wine liberated by providing accessibly priced options, and we’ve seen that resonate with our consumers,” Ekundayo says.

The price point also makes the brand well suited to the on-premise segment. “We’ve been focused on growing distribution and driving conversion on ecommerce, but are looking forward to driving awareness and trial with larger consumer activations this year,” she says.

The Pale, a rosé brand from Provence, made its debut in spring 2021 and is already a Rising Star. “The Pale is vibrant, extravagant and elegant, but it is also an affordable luxury, which will appeal to a younger consumer,” says Sydney Hunter-Edwards, national brand ambassador for The Pale.

Easy, Portable Packaging

In addition to affordable luxuries, consumers want convenience. That’s why The Pale decided on a screw cap rather than cork closure, Hunter-Edwards says. “The new generation is all about ease and accessibility so we knew we needed to tap into that mindset.”

Risata updated its Moscato wine packaging (Moscato d’Asti, Pink Moscato and Red Moscato) in 2021 to a twist-off capsule. “This change offered convenience and product consistency for our on-premise supporters as the bottles are easier to open, offer more consistent quality, and extend the shelf life of the wine,” Flom says.

Consumers are seeking out small-format bottles as a solution to enjoying wine in moderation, without opening a full standard-sized bottle, she adds. “The Risata brand has built new offerings off of this trend for the coming year.”

For instance, “We are also rolling out Risata Prosecco 187-ml. single serve. With the popularity of single-serve products, we wanted to offer an additional entry in this size for the Risata brand tailored to both on-premise and consumers enjoying at home.” The brand currently offers Risata Moscato d’Asti 187-ml. single-serve bottles.

Yes Way Rosé has had success with its Yes Way Rosé Bubbles in a 187-ml. single-serve offering, says cofounder Erica Blumenthal. “The packaging focuses on hotel grab-and-go sections, by-the-glass features, stadium venues and other on-premise outlets where consumers seek the convenience of a single-serve offering.”

FRE in January 2020 launched Sparkling Rosé and Sparkling Brut, the first single-serving alcohol-removed wines. One Covid-related challenge the brand faced was the can shortage, Wohld says. “Our FRE Sparkling Brut and Sparkling Rosé offerings were even more popular than we had anticipated, and we’re adjusting our production plan to meet the growing demand.”

Cupcake LightHearted also felt the effects of pandemic production problems. “We’ve all heard about the challenges within the global supply chain,” Dubiel says, “and the brand has done an incredible job of quickly pivoting when necessary, supporting our people and working together to ensure that we have product on the shelves for our consumers.”

Elevating the Everyday

Most of the Growth Brands winners interviewed say that they plan to focus on digital and social media marketing, e-commerce and influencer strategies.

FRE aims to grow consumer awareness through investment in advertising, says Wohld. “Consumer education is also a priority for us; it’s important that we continue to convey how the wine is crafted and demonstrate how FRE can fit into every lifestyle.”

Mind & Body has partnered with “several phenomenal influencers who create content — from yoga sessions to at-home workouts — that speaks to our fitness roots,” she adds.

For Unshackled, “we are building out a campaign for the brand that revolves around the idea of creative expression, defying conventions and traditional labels,” Ekundayo says. “Our winemakers appreciate authenticity and creative expression as much as our consumers do.”

The continued reopening of bars and restaurants has boosted Meiomi’s growth, Lagor notes. “We had strong penetration in the on-premise segment pre-pandemic, which is so important to drive awareness and trial.”

On-premise will also be a larger focus for The Pale, Hunter-Edwards says. “And now that wine and food festivals are back, we will definitely be popping up around the country throughout the year to welcome everyone to the soirée!”

For its flagship 750-ml. bottle, Yes Way Rosé aims to focus on by-the-glass menu placements in 2022, Blumenthal says. “We are also partnering with an artist to create a special edition package to celebrate our fifth vintage, launching in June.”

“Moët Hennessy always looks for ways to innovate and reach new consumers, “while ensuring that we are honoring the history and heritage of our brands,” Stock says. “Whether through partners that we engage, or institutions that we partner with such as the NBA, we strive to find voices that can connect our centuries-old brands with modern day and speak to Champagne lovers and new audiences alike.”

After all of the upheaval of the past few years, many winemakers hope to encourage customers to celebrate the everyday victories rather than wait for milestone events. For instance, Risata went through a full creative review for the brand and worked with an integrated creative agency to launch its “This calls for Risata” campaign.

The campaign offers a refreshing take on the everyday by celebrating small wins and elevating everyday moments, Flom says. “We saw this resonate with consumers during the hard times of the last couple of years.”

Feature photo by Pier Demarten on Unsplash.