While beer sales have seen a lift this year due to consumers stocking up, the category has faced significant challenges as more consumers turn to spirits, and cocktails and wine encroach on traditional beer-drinking occasions. The proliferation of craft and regional styles has also led to a head-spinning array of choices for consumers.

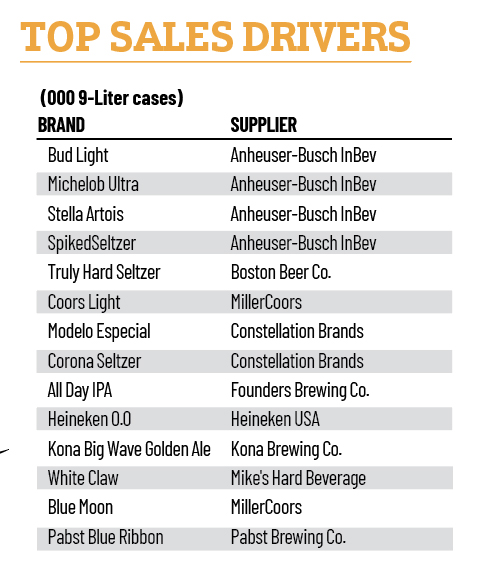

Our annual Beer Growth Brands Awards winners indicate what’s trending, from new IPA iterations and ales to the ever-popular hard seltzers, Mexican imports and good old domestic light beer. How did we calculate our annual Beer Growth Brands Awards this year?

We polled our pool of beverage alcohol retailers, on-premise operators and other industry professionals about the beer brands that sold best for them in the past year. Their responses helped shed light on the brews consumers prefer now, and provided context in defining the current beer category as a whole.

IPAs still A-OK

Interest in the red-hot IPA beer subcategory has cooled a bit, but India pale ales remain favorites of beer enthusiasts. Just one brand, All Day IPA from Grand Rapids, MI-based Founders—made the list of Top Sales Drivers. But two of the Best New Products are IPAs: 4 Giants IPA, also from Founders, and Dogfish Head Perfect Disguise Double IPA.

The key to All Day IPA’s growth is the brand’s core benefits, says Sandy Anaokar, vice president of marketing at Founders. “It’s a low-alcohol, full-flavored IPA sold at an accessible value,” he says.

“In 2019, we flighted two online video campaigns on Hulu and YouTube: our ‘Session Boldly’ videos (which first ran in 2018), which celebrates how All Day IPA helps augment life’s little adventures, and our new brewery equity message, ‘Chase Your What If’, which touts how our brewery helped change the craft brewing landscape with brands like All Day IPA,” Anaokar says.

And knowing that All Day consumers love traveling, “we augmented this message of innovation and adventure with on- and off premise campaigns like the All Day Getaway contest, which gave consumers the opportunity to win a dream trip to Spain.”

Good for what ales you

New Belgium Brewing Co., which makes Fat Tire Amber Ale, picked up a win this year for Best Activation Programs, as did Sierra Nevada Brewing Co., which is known for its flagship Pale Ale.

Hawaii’s Kona Brewing Co. had two winners: Big Wave Golden Ale, as a Top Sales Driver, and Island Colada Cream Ale, a Best New Product. Kona ran its first national TV commercials in 2019, during March Madness, says senior brand manager Ashley Picerno, “bringing Kona to more consumers than ever before.”

In Kona’s “Dear Mainland’ advertising campaign, which has been running since 2014, “the lovable Bruddahs share their sage island wisdom with Mainlanders, gently and humorously pointing out how get more balance in their lives,” Picerno says. “This was further amplified in programming both on-premise and at retail to reinforce the message.”

Fast-moving Mexican brews

Beer brands from Mexico nabbed a few awards this year. Corona won for Best Activations and Promotions, while Modelo Especial won for Best Advertising and Promotions as well as Top Sales Driver.

Corona Premier and Modelo Especial, both owned by Constellation Brands, had stellar marketing programs in 2019 “that were rooted in deep consumer insights and what our brands stand for,” says John Alvarado, Constellation’s senior vice president brand marketing. “These programs led to us effectively engaging consumers and continuing to build Corona Premier and Modelo Especial.”

For Corona Premier, “our multi-year partnership with the U.S. Open of Golf and our focus on wellness-specific initiatives propelled the brand forward in 2019,” says Ann Legan, vice president brand marketing for Corona. The brand also developed an integrated platform with year-round support and tools for healthy grilling and fitness, she says.

Modelo Especial focused on a strong philanthropic platform with programs such as the Modelo Fighting Chance Project Concert Series with the artist Anderson .Paak, and the Leave No Veteran behind activation, says Greg Gallagher, vice president brand marketing for Modelo. The brand also introduced a 32-oz.-bottle format, “which enabled greater feature and display and differentiation in C-stores amid a single-serve heavy market,” he says.

Modelo celebrated its Hispanic heritage with programming around Cinco de Mayo with retail activation and Día de los Muertos, and reached its core Hispanic consumer with programming around the Gold Cup, Gallagher says. The brand also continued its strong activation with UFC, “including our first ever UFC watch party activation, which brought the fight to life in four core markets—Los Angeles, New York City, Denver and Phoenix—as well as developed robust tools to support on- and off-premise,” he adds.

Hard seltzer sizzles

It’s no surprise that a number of flavored malt beverages—namely hard seltzers—made the list of Top Sales Drivers. These include Spiked Seltzer, Truly Spiked & Sparkling and White Claw, as well as the new Corona Seltzer, which also won Best New Product. Other winning new entries to the category include Vizzy by MillerCoors for Best New Product, and Bud Light Seltzer, which won Best New Product as well as Best Activation Programs.

“Seltzer is a huge trend that has impacted the beer industry in the past year, and we don’t see that stopping anytime soon,” says Corona’s Legan. While the brand was introduced into the market in March 2020 —just as the pandemic took hold—Corona Hard Seltzer made adjustments to television and point-of-sale to address the change in consumer behavior, she says.

Kona this past spring launched Kona Spiked Island Seltzer, available in four Hawaii-inspired flavors: Tropical Punch, Starfruit Lime, Strawberry Guava and Passion fruit Orange Guava. “Hard seltzers have disrupted the beer market in a substantial way, as consumers look for lighter, better-for-you alcohol options,” Picerno says.

“This trend has also impacted beer, with light beers and lighter styles such as lagers and blondes growing in popularity,” she notes. Kona this year unveiled Kona Light, which Picerno describes as an easy-drinking, 99-calorie island blonde brewed with tropical mango.

The low-calorie beverage trend that seltzer has tapped into deserves special attention, says Anaokar at Founders. “We’d be foolish to not understand the impact that hard seltzer has had on the entire alcohol category. While it’s easy to say that 1) this is a fad; and 2) this does not impact craft beer drinkers, this point of view would be incredibly shortsighted and would overlook the roles these brands play in consumers lives,” he says.

“We have to not think all low-calorie drinkers and all traditional craft beer drinkers are mutually exclusive consumers,” Anaokar adds, “but rather, could work hand-in-hand to provide a solution across a number of consumer occasions.”

The COVID effect

Most brands are experiencing new consumer behaviors due to COVID-19. The pandemic “has forced us to adjust our marketing plans for the year, as much of what we had planned was unrealistic in our new environment,” says Constellation’s Alvarado. Modelo Especial adapted quickly to focus efforts on a campaign with #FirstRespondersFirst that supported front-line workers during the pandemic, Gallagher says.

While the coronavirus has had an unprecedented impact on the beer industry, Kona has pivoted where needed “to support our bars and restaurants through the reopening process and to ensure retailers are stocked with plenty of everyone’s favorite Kona brews,” Picerno says.

What’s more, “our spring launch of Spiked Island Seltzer was perfectly timed with the explosion of hard seltzer consumption during COVID-19.”

The aluminum can shortage has had an impact on the entire beverage industry. “As craft beer in cans has reached a point of ubiquity coupled with the increased demand in overall beer, the emergence of seltzers and the organic increase in at-home drinking due to COVID-19, there will be a pinch that all brewers will have to plan for,” Anaokar says. “Much like everything that this health crisis is impacting, we are all in this together—the vessel suppliers, the brewers and, in an indirect way, the consumers.”

While the team at Founders doesn’t have all of the answers now, Anaokar notes, “we are actively planning and preparing for how we can give consumers the liquids and brands they need, balanced with the supply of cans and bottles we are able to procure.”

Feature photo by Rhett Wesley on Unsplash.