Thanks to the top vodka trends in 2021, this behemoth category survives and thrives — even during the pandemic — with its versatility, mixability and enduring popularity.

At-home consumption spurred sales via takeout cocktails from bars and restaurants, and home mixologists stocking up on large-format bottles and mixers, aided by a loosening of regulations and boosted by e-commerce.

As Covid restrictions ease and on-premise traffic revives, those factors will continue to drive growth, augmented by innovation, new flavors and expressions and marketing. Producers, bars and restaurants and retailers remain bullish on vodka.

“Vodka is still the most popular spirit category in terms of number of drinks sold. No question,” says Thomas Moore, divisional bar training manager at Aba, a Mediterranean concept in Chicago that opened another location in Austin this past October. “With vodka, guests are typically looking for classics: Espresso Martinis, Moscow Mules, Vodka Sodas and Vodka Martinis.”

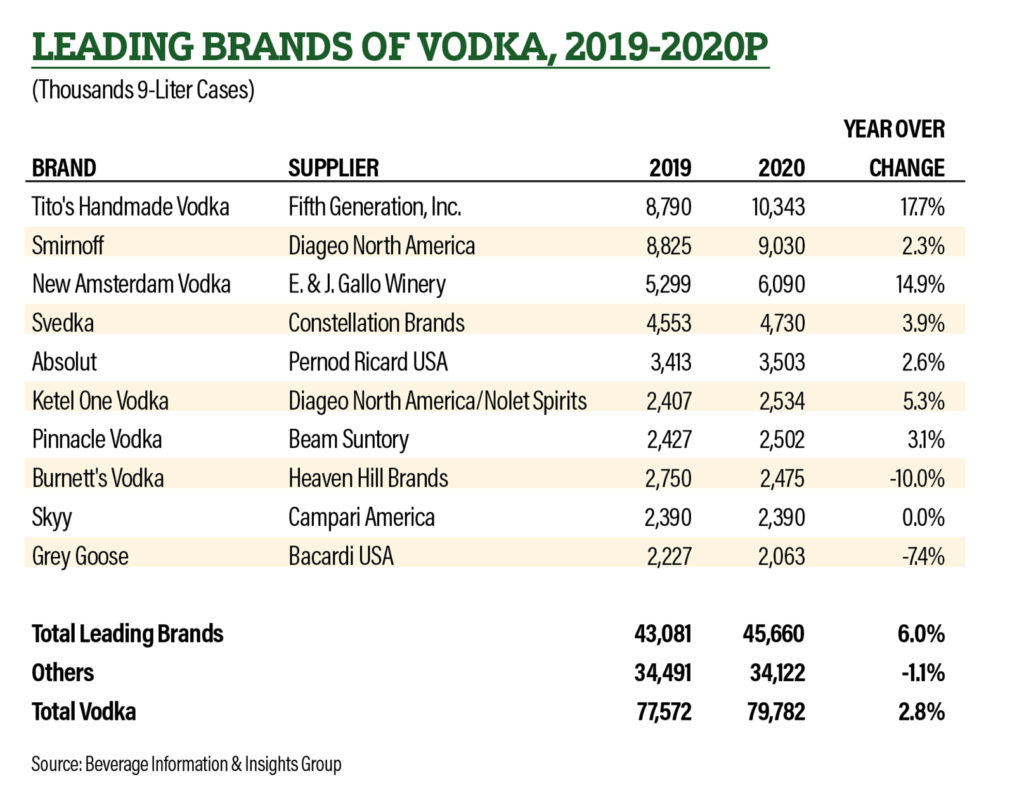

In terms of volume, vodka increased 2.8% in 2020 to reach 79.8 million 9-liter cases, according to the Beverage Information Group’s 2021 Handbook Advance. “It’s the number-one spirit in the U.S., accounting for one-third of all cocktail sales nationwide,” says Martin de Dreuille, vice president global marketing for Grey Goose vodka.

While pandemic lockdowns have decreased on-premise sales at bars and restaurants, “we’ve been fortunate to see spikes in sales from shops and liquor stores, which represent a significant portion of our North American sales, as well as unprecedented growth in e-commerce,” de Dreuille notes.

“Our vodka SKU count is always growing, due to new products and brands becoming available to our distributors,” says Shaina B. Jones, store manager at Sodie’s Wine & Spirits, in Fort Smith, AR. Sodie’s carries 560 SKUs of vodka; the category accounts for 18% of the retailer’s overall spirit sales.

Vodka consumption continues to be a massive driver in the spirits industry, says Erin King, director of brand marketing and on-premise for Western Son vodka. “With all the buzz about whiskey, tequila and RTDs, sometimes vodka is a little forgotten, but vodka is still on every backbar, home bar and shopping basket. It’s a staple.”

Focused Approach on Vodka Trends

Although vodka is a workhorse at every bar and restaurant, some establishments specialize in the spirit.

“Vodka is a foundational piece to our restaurant; it’s tied to the concept and the culture of Eastern European dining,” says Israel Morales, co-owner and beverage director of Kachka restaurant in Portland, OR. “We carry a good number of vodkas that are unique and hard to find, and in that way we have become a destination.”

Even though Kachka specializes in Eastern European vodkas, particularly Russian, it also carries vodkas from all over the world, as well as from a bevy of local distillers. When in full swing, Kachka offers about 60 different vodka selections and a dozen house-made infusions.

Morales searches out non-traditional vodkas, such as Snow Leopard, a Russian vodka made from spelt, as well as Covington’s Sweet Potato Vodka from North Carolina, and Vermont Gold Vodka distilled from whey, which confers a distinctly creamy mouthfeel. “Vodkas that are not only different but delicious,” he says.

Cool and Creative

While most vodka is grain-based — corn, wheat, rye — or made from potatoes — vodka’s lack of strict rules allows enterprising distillers wide latitude in distillates to create new and unexpected iterations.

Good Liquor Works, for example, produces vodka from coffee pulp, a waste product of coffee bean production. Highway Vodka, hailing from Houston, is crafted from hempseed. Made from California grapes, Caveman Vodka claims to be “Paleo-inspired.” And in India, Smoke Lab distills vodka from basmati rice grown in the Himalayan foothills, which is available in original and aniseed-flavored expressions. In Louisiana, JT Meleck also produces Rice Vodka, at a distillery surrounded by rice fields.

Crystal Head last fall released Onyx, which is Weber blue agave-based, and joins corn-based Crystal Head Original and Crystal Head Aurora, made from wheat.

“Our approach is to make a top-quality product that leaves flavors and notes from the raw ingredient in the vodka,” says Chuck Kane, chief operating officer of Chopin Imports. The portfolio includes: Chopin Potato, Chopin Rye, Chopin Wheat and Chopin Family Reserve.

Water also makes a difference in the final product. For example, Grey Goose sources pure spring water from its natural well in Gensac-la-Pallue, France. Finlandia vodka, distilled in the Finnish village of Koskenkorva, is made with pure glacial spring water and Suomi barley.

Taking a different approach is Dirty Devil vodka, produced in Canada by St. Lucifer Spirits from non-GMO corn and hyper-oxygenated water. This latter ingredient is created via a patented process that yields water with five times the oxygen of ordinary water.

Fruit Loops and Vodka Trends

The current “It” flavor seems to be pink lemonade, which is perhaps related to the mania for rosé wines and pink-hued gins.

Sodie’s top-selling vodka flavor at the moment is New Amsterdam Pink Whitney, says Shaina Jones. The pink lemonade-flavored vodka is a collaboration between New Amsterdam vodka and hockey player Ryan Whitney, inspired by the NHL star’s favorite drink. “Smirnoff Pink Lemonade just arrived at our store and we are sure it will be a big hit,” Jones adds.

Western Son’s newest flavor is lemon, launched this year. “We’re excited to have a citrus in our portfolio, especially with citrus being 25% of the flavored vodka market share, it’s important to play in that arena,” King says. Blueberry is the brand’s number-one flavor, although non-flavored original captures the lion’s share of sales.

The Grey Goose portfolio features a number of flavor expressions including La Poire, L’Orange and Le Citron. “Of course, Grey Goose original is our hero product and by far the most popular,” notes de Dreuille.

Deep Eddy Vodka earlier this year launched a lime-flavored expression, joining its lineup of Orange, Peach, Lemon, Ruby Red, Cranberry and Sweet Tea, as well as Original.

For the summer season, Absolut Vodka recently unveiled Absolut Watermelon, meant for easy mixing, from simple recipes like the Watermelon Vodka Soda to more advanced cocktails.

Essence of Botanicals

A plethora of natural-flavor vodkas enhanced with botanicals have recently hit the market. For example, Svayak Vodka last fall debuted Royal Botanical, a vodka from Belarus infused with 12 different spices and herbs.

Grey Goose in April launched the Essences line, which includes three variations of vodka infused with real fruit and botanicals: Strawberry and Lemongrass, Watermelon and Basil, and White Peach and Rosemary. There’s real consumer interest in low-ABV and botanical-infused spirits, says de Dreuille. “Grey Goose Essences has seen incredible sales already, 50% above our plans.”

Also in April, Pinnacle vodka unveiled the Pinnacle Light & Ripe innovation line, featuring Apricot Honeysuckle and Guava Lime flavors. And in May Belvedere announced the launch of Belvedere Organic Infusions. Made with organic fruits and botanicals, the line is available in Lemon & Basil with a touch of elderflower; Pear & Ginger with a drop of Linden Honey; and Blackberry & Lemongrass with a hint of sage.

Stocking Up and Trading Up

Large formats are selling like gangbusters in the off-trade. House-bound consumers stocked up in a big way last year, and grabbed myriad mixers off the shelves as well.

As people honed their at-home mixology skills during the pandemic, “consumers are definitely buying more mixers and garnishes with their vodka purchases to make cocktails at home,” says Jones. Sodie’s has digital tablets located in every aisle that contain a searchable library of cocktail recipes.

And consumers have been reaching higher on the shelves too. Revenue in the high-end premium vodka segment, grew 10.7% according to Distilled Spirits Council of the U.S., which was double the category’s growth.

“Customers are definitely trading up when it comes to vodka. Price is no longer the primary consideration when making a purchase; they do not want to sacrifice quality,” says Kane.

Consumers have also traded up on size, Kane adds. “We are currently up 45% over last year (Q1) and projecting our 1.75-liter business to double by the end of 2021.”

“There’s a noticeable trend in consumers trading up to superpremium spirits, and vodka is not an exception,” says Allison Varone, vice president of emerging brands at Moët Hennessy, whose portfolio includes Belvedere vodka. “During the pandemic we did see growth on our larger sizes, as Covid-buying habits changed while consumers stayed at home more and experimented with their favorite spirits and cocktail creations.”

The line includes the flagship Belvedere Vodka Pure; two single estate expressions, Lake Bartek and Smogóry Forest; and Heritage 176.

At Sodie’s Wine & Spirits, “Customers are definitely stocking up with larger sizes: Our top-five selling vodka SKUs are all 1.75 liters,” says Shaina Jones. Tito’s is by far the best selling vodka brand at Sodie’s, with Smirnoff and Pinnacle in a close run for second place. “We sell far more domestic vodka brands than imported brands.”

Sodie’s also looks for new ways to feature specific categories. The retailer features gift packages, such as a Martini Basket, which contains everything needed to make Martinis, including recipes and glassware.

Back to the Bar

With on-premise opening up, bartenders are getting creative and reaching for vodka.

“Vodka’s stealthy persona and versatility in cocktail design makes for endless creative opportunities,” says Jay Jones, lead bar development manager for Joey Restaurants. The Vancouver, BC, Canada, casual-dining chain operates 27 Joey Restaurant locations across Canada, Washington and California.

Joey Restaurants carry more than a dozen different vodkas, in a variety of brands, styles and flavors, Jones says. A Joey signature is the Super Nova Vodka Soda, which elevates the classic highball with a frozen finish of lemon-lime slush.

Another popular vodka refresher is the Leading Lady, a mix of peach vodka with grapefruit and elderflower, emulsified with egg white, topped with sparkling wine and garnished with fresh grapefruit peel and rosemary. Cocktail prices range $11 to $16.75.

“We’ve recently added the Rosé Spritz to our menu,” says Jay Jones, which combines Absolut Juice Strawberry vodka and rosé wine, with splashes of grapefruit, lemon, peach and club soda. Jones is reviving the popular Watermelon Drink for summer, made with Absolut vodka, fresh watermelon juice, a dash of organic cane syrup, fresh mint and lime juice, and he’s planning to add a vodka-based specialty Champagne Cocktail.

At the recently opened Aba Austin, the signature cocktail is the Mediterranean Mule. “We added complexity to the Moscow Mule with Mediterranean ingredients, infusing vodka with rosemary and thyme as well as orgeat,” says Moore.

The Livin’ Easy cocktail includes Chareau (an aloe liqueur from Southern California), strawberries and Aperol. Aba’s drink prices range $13 to $14 for the specialty menu, and $19 to $22 for the reserve menu.

The Aba bars carry five different vodkas. “By far, we reach most often for Tito’s because it’s the most requested,” Moore says.

Aba Austin’s spring reserve menu includes an Espresso Martini using a single-estate rye vodka. “We’re also rolling out an entirely new category of large-format cocktails that we call Groupies,” says Moore. “There’s been a trend of vodka brands releasing products with natural botanical infusions, so we’re going to use one with strawberry and lemongrass in a delicious, tropical cocktail.”

Kachka has a robust cocktail program, says Morales with a product mix that’s 50/50 cocktails and vodka shots. “A Moscow Mule is our highest seller because people can pronounce it and know what it is.” The restaurant’s version of a Martini is 1950s-style, heavier on vermouth and orange bitters.

House-made vodka infusions play a key role in Kachka’s beverage program. The restaurant in November partnered with local distillery Martin-Ryan to bottle and distribute its horseradish vodka infusion in liquor stores throughout Oregon.

Sips and Shots

“Any vodka can be sipped, it depends on what sensation you’re after,” explains Jay Jones at Joey Restaurants. “A simply bold and vivid vodka such as Smirnoff gives scintillatingly warm sensations, while Absolut does the same, but adds a little more texture on the palate.”

More understated vodkas such as Ketel One, offer smooth and clean sensation, he continues, “while the robust character of Tito’s makes more of an impactful sensory statement. An ultra-premium experience comes from contemplation of something purposely designed for true luxury, such as Absolut Elyx, a copper pot-distilled, single-estate, winter wheat vodka.”

People in Eastern Europe traditionally take shots of vodka with small bites of food, says Morales, and customers at Kachka eat and drink the same way. In Russia, vodka is measured in grams, so Kachka offer three shot sizes, 30 grams, 60 grams and 100 grams (3 oz.).

The two larger sizes are served in carafes so customers can pour for themselves and for friends, which is part of the camaraderie. Prices for a 30-gram pour range about $4 to $8 or $9.

Although vodka is served chilled at Kachka, two special, complex expressions are served at room temperature in a larger snifter glass so that guests can swirl it for more aromatics. One is Polugar, a rye vodka made in a pot still; the other is Vestal, a single-varietal Polish potato vodka sourced from a single parcel.

Kachka also has some pre-set vodka flights on the menu, “which may showcase the offerings of a single distiller, for example, or a certain region, or contrast ingredients, grape-based versus potato,” explains Morales. “Rigorous training for all our staff allows them to speak about vodka with the same confidence any server should be able to speak about wine.”

Joey has embraced the opportunity to transform its cocktails into at-home experiences, says Jay Jones, offering multiple-serving cocktail kits as well as single-serve to-go formats. Joey vodka-based Cocktail Kits include The Joey Mule, as well as the signature Super Nova Vodka Soda, and Super Stoked Vodka & Coke Kits.

A Promising Outlook

“The year 2021 is off to a terrific start for our brand and the vodka category,” says Kane. “People are giving vodka, and more specifically, premium vodka, a second look.

Chopin will stick with some tried-and-true traditional advertising, while beefing up its digital presence with the accelerated shift in internet usage and shopping, he notes. Chopin in February announced a partnership with designer Vera Wang, who personally selected the special variety of young potato for Vera Wang x Chopin and designed the bottle and the personal message on the back bottle.

Western Son leans heavily into digital to promote brand awareness, including influencer partnerships, says King. The company, which donates a portion of sales to the non-profit Peter Burk’s Unsung Hero Fund, this summer will launch Spiked Ice Fruit Infusions, a Popsicle-like novelty, at 8% ABV. “Innovation is key for a brand like ours,” says King.

Belvedere will continue its Made with Nature communications platform that launched last year, says Varone, “which tells the story of Polska rye, purified water and nothing else, illustrating how the utmost respect for the land ultimately translates into our brand.”

Varone expects to see solid growth for Belvedere this year as consumers resume some sense of normalcy and the on-premise reopens. “The expectation is also that some habits formed during the pandemic will stick, where consumers will continue to prioritize high-quality, local ingredients and all natural brands when making lifestyle choices.”

Thomas Henry Strenk is a Brooklyn-based writer specializing in all things drinkable.